|

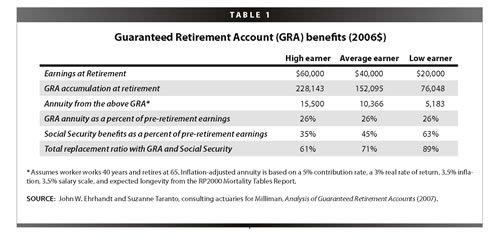

November 20, 2007 | EPI Briefing Paper #204 Guaranteed retirement accountsToward retirement income securityby Teresa Ghilarducci Download print-friendly PDF version For most of the last century, American retirement income policy supported a combination of programs—Social Security and federal tax subsidies for traditional defined-benefit pensions and for voluntary personal retirement accounts—that enabled many people to stop working and to maintain their living standards in retirement, while reducing old-age poverty rates. But the American retirement income security system is breaking down. If current trends continue, poverty rates among the elderly will increase and middle-class retirees will find that their retirement income will not pay for the lifestyle they achieved while working. This will be the first time since World War II that the standard of living of elderly Americans declines while that of prime- age workers increases. This reversal is due to tax and regulatory policies that fail to promote retirement savings and penalize defined-benefit plans. Regulations favor, and tax subsidies increasingly go to, the wrong kinds of retirement programs. As a result, 401(k) plans and other defined-contribution plans1 that were designed to supplement, not replace, traditional pensions are growing at the expense of defined-benefit plans that provide secure supplemental income to Social Security. Tax breaks for 401(k) plans amounted to $110 billion in 2006, most of which went to households in the top tax brackets. These tax breaks mostly cause wealthy households to shift savings to tax-favored accounts rather than increase overall savings (Chernozhukov and Hansen 2004; Engen and Gale 2000)—thus the paradox that taxpayers are giving up more and more revenue to promote retirement savings while retirement security declines. In fact, the Urban-Brookings Tax Policy Center found that income tax expenditures for retirement plans were actually larger than personal savings in 2003, including contributions to retirement plans (Bell, Carasso, and Steuerle 2004). This occurred despite a confluence of factors that should have boosted savings growth, including a sharp increase in the amount of money people could shelter from tax in accounts that are intended for retirement savings, an older and more educated workforce, and an economy in which the wealthy, who tend to save more, have received the lion’s share of recent income increases. This paper proposes a rescue plan for the American retirement income security system, based on a mixed system composed of Social Security, employer defined-benefit pension plans, and a new type of personal retirement savings account called a Guaranteed Retirement Account (GRA). This rescue plan will not work without a strong defined-benefit pension system and a strong Social Security system. Tax breaks for 401(k)-style plans and IRAs will be converted into flat tax credits to offset the cost of these new accounts, so the plan will improve the retirement security of most Americans without costing taxpayers more than the current system. The plan calls for all workers not enrolled in an equivalent or better defined-benefit pension to enroll in a GRA, a plan that borrows the best features of defined-benefit and defined-contribution plans, including guaranteed retirement benefits that last a lifetime, low administrative costs, and steady contributions. With GRAs, workers will accumulate savings in investment funds that earn a rate of return guaranteed by the federal government. These funds will be converted to life annuities upon retirement. Along with Social Security benefits, these will replace approximately 70% of pre-retirement earnings for the typical retiree. Guaranteed Retirement Accounts eliminate the regulatory and tax law favoritism that not only gives 401(k)-type plans wide discretion and little scrutiny, but does so at the expense of the defined-benefit system. Most defined-benefit plans yield a much higher benefit than even Guaranteed Retirement Accounts, though they typically also require average contributions of over 6% of payroll for sustainability. The Guaranteed Retirement Account plan will help reverse the slide in employer-provided defined-benefit plans. Employers who are now considering converting their defined-benefit plans to 401(k)s to save money will find that option much less attractive without tax benefits, and will therefore be more likely to retain their defined-benefit plans. Meanwhile, employers currently offering 401(k)s as a recruitment and retention tool may switch to defined-benefit plans, since particular employers cannot distinguish themselves by offering Guaranteed Retirement Accounts (as with Social Security). The first section of this paper describes GRAs. The second and third sections provide an overview of the current system and describe how it increasingly fails to meet 10 standards of a good retirement security system. The fourth section explains how the Guaranteed Retirement Account plan would address these failures, and the fifth answers questions about the plan. The final section compares the plan to other reform ideas, such as auto 401(k) enrollment and raising the retirement age. How Guaranteed Retirement Accounts workStructure. Guaranteed Retirement Accounts are like universal 401(k) plans except that the government, as befits a large and enduring institution, will invest and manage the pooled savings. Participation. Participation in the program is mandatory except for workers participating in equivalent or better employer defined-benefit plans where contributions are at least 5% of earnings and benefits take the form of life annuities. Contributions. Contributions equal to 5% of earnings are deducted along with payroll taxes and credited to individual accounts administered by the Social Security Administration. The cost of contributions is split equally between employer and employee. Mandatory contributions are deducted only on earnings up to the Social Security earnings cap,2 and workers and employers have the option of making additional contributions with post-tax dollars. The contributions of husbands and wives are combined and divided equally between their individual accounts. Refundable tax credit. Employee contributions are offset through a $600 refundable tax credit, which takes the place of tax breaks for 401(k)s and similar individual accounts and is indexed to wage inflation. Eligibility for the tax credit is extended to part-time workers, caregivers of children under age six, and those collecting unemployment benefits. If an individual’s annual contributions amount to less than $600, some or all of the tax credit is deposited directly into the account in order to ensure a minimum annual deposit of $600 for all participants. Fund management. The accounts are administered by the Social Security Administration and funds are managed by the Thrift Savings Plan or similar body. Though funds are pooled, workers are able to track the dollar value of their accumulations, as with 401(k)s and other individual accounts. Investment earnings. The pooled funds are conservatively invested in financial markets. However, participants earn a fixed 3% rate of return adjusted for inflation, guaranteed by the federal government. If the trustees determine that actual investment returns have been consistently higher than 3% over a number of years, the surplus will be distributed to participants, though a balancing fund will be maintained to ride out periods of low returns. Retirement age. Participants begin collecting retirement benefits at the same time as Social Security, and therefore no earlier than the Social Security Early Retirement Age. Funds cannot be accessed before retirement for any reason other than death or disability. Retirement benefits. Account balances are converted to inflation-indexed annuities upon retirement to ensure that workers do not outlive their savings. However, individuals can opt to take a partial lump sum equal to 10% of their account balance or $10,000 (whichever is higher), or to opt for survivor benefits in exchange for a lower monthly check. A full-time worker who works 40 years and retires at age 65 can expect a benefit equal to roughly 25% of pre-retirement income, adjusted for inflation, assuming a 3% real rate of return (see Table 1). Since Social Security provides the average such worker with an inflation-adjusted benefit equal to roughly 45% of pre-retirement income, the total replacement rate for this prototypical worker will be approximately 70%.

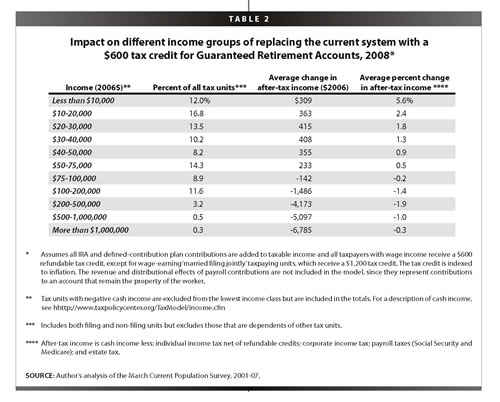

Death benefits. Participants who die before retiring can bequeath half their account balances to heirs; those who die after retiring can bequeath half their final account balance minus benefits received. Overview of the current systemSocial Security, pensions and personal savings are often referred to as the three pillars of the U.S. retirement system. Social Security. Social Security is the bedrock of retirement income support for most Americans, replacing about 45% of pre-retirement income for the average steady worker (more for low earners and less for high earners). However, the U.S. Social Security system was never designed to provide all the income that retirees need, and is less generous than those in most other advanced industrial countries (OECD 2007). And while it remains by far the largest source of retirement income for most Americans, replacement rates are falling as the Social Security full benefit age is pushed up, at the same time that Medicare premiums are rising (Munnell 2003). Pensions. Until the mid-1990s, the most prevalent employer-provided retirement plan was a traditional defined-benefit pension that ensured a secure retirement after a lifetime of work. Though these pensions are still common in the public sector and at large corporations with white-collar or unionized workforces, employers have increasingly replaced them with less secure 401(k) plans. As a result, the share of family income the median 67-year-old receives from traditional defined-benefit pension plans is expected to fall from 20% for current retirees to only 9% for the late baby boom generation. Defined-contribution plans will not fill the gap, since the share of income from retirement accounts is expected to rise only from 3% to 7% of income (Butrica et al. 2003). Because defined-contribution plans are substituting for defined-benefit pensions, overall coverage, rather than expanding, has stayed flat or contracted, leaving half of all full-time workers (and most part-time workers) with no workplace retirement plan at all, a situation that has remained essentially unchanged for at least a quarter century.3 Voluntary savings. Household savings rates are at their lowest levels ever measured, hovering near zero in 2006 from a high of 10% in the late 1970s and early 1980s (Bosworth and Bell 2005; Munnell, Golub-Sass, and Varani 2005). But the decline in retirement security for post-baby-boomer generations has little to do with how much households have set aside in bank accounts or mutual funds, since savings as commonly understood have never played a significant role in funding retirement for most Americans. And while the savings rate has fallen, wealth-to-income ratios have remained stable in recent years, in part due to rising stock and housing prices (Bosworth and Bell 2005; Delorme, Munnell, and Webb 2006). The problem is that wealth measures—which usually include assets in 401(k) accounts and IRAs but not pension fund accumulations—should be rising to make up for the decline in defined-benefit pensions and cuts in Social Security. Strengths and weaknesses of the current systemPension and savings systems are key components of the social wage and represent a substantial taxpayer commitment. Thus, they should be effective, efficient, fair, and based on mutual responsibility and shared risk. Americans should ask the following 10 questions about their retirement system. Does the U.S. retirement system provide adequate retirement income? For most of the 20th century, the share of elderly Americans living in poverty steadily declined and each succeeding generation was better able to afford retirement than the previous one. These improvements were largely due to expanding Social Security benefits, as well as the spread of employer-provided defined-benefit pensions. However, if current trends continue, the early baby boomers will be the last generation with more retirement security than their parents (Butrica et al. 2003). Social Security benefits have been trimmed back, health care and long-term care costs are rising, and 401(k) plans are displacing more secure defined-benefit pensions. As a result, many older Americans are working longer or taking part-time jobs, with nearly one in four people between the ages of 65 and 74 (23.2%) participating in the labor force in 2006, up from 19.6% in 2000,4 a trend that is expected to continue (Butrica et al. 2003). Workers, rather than employers, increasingly bear the responsibility for funding retirement. Workers must generally elect to participate in a 401(k) plan, whereas workers are automatically enrolled in traditional defined-benefit plans (which in the private sector are entirely employer-funded). Firms have an incentive to persuade workers to favor 401(k) plans over defined-benefit pensions because workers typically bear more than half of the cost of 401(k) plans. In addition, employers save money when workers do not participate. Is the system fair? Certain groups are especially ill-served by the current system, including part-time workers, divorced and widowed women, individuals with long-term care needs and medical expenses, and racial and ethnic minorities. Over 60% of unmarried women and more than 56% of African Americans and Hispanics approaching retirement age have expected retirement incomes below twice the poverty level (Weller and Wolff 2005). Though these groups are also more likely to have lower-than-average incomes in their working years, the retirement system exacerbates this inequality. Policy makers offer tax advantages to retirement plans if they include rank-and-file workers, but this incentive has become less potent and more tilted toward employers with a high-income workforce as marginal tax rates have fallen. And while tax subsidies for defined-benefit pensions also tend to favor workers with good jobs, these are less regressive than those for defined-contribution plans because participation in these plans is automatic and benefits are distributed more equally. Tax breaks for 401(k)s and other voluntary retirement accounts are skewed to the wealthy because it is easier for them to save, and because they receive bigger tax breaks when they do so. The value of these tax breaks is equal to the investment earnings on the deferred taxes, which in turn depends on the marginal tax rate paid by a household. A wealthy family in a 35% tax bracket gets a tax break three-and-a-half times more valuable than a family in a 10% tax bracket, even if each family contributes the same dollar amount to a 401(k). As a result, economists at the Urban-Brookings Tax Policy Center have found that 70% of tax subsidies for defined-contribution plans and IRAs go to those in the top 20% of the income distribution and almost half go to the top 10% (Burman et al. 2004). All in all, only 29% of households received a tax break for contributing to defined-contribution plans or IRAs in 2004 (Burman et al. 2004). So while the average tax break per household was worth around $530, this figure is misleading because it includes households who received no tax break at all. For the lucky few who did, the average value was over $1,800.5 Another problem with defined-contribution plans and IRAs is that they exacerbate the retirement income gap between men and women. Though 401(k) and IRA funds are considered marital property, no spousal consent is required for fund distributions and funds can be hidden or depleted before divorce (Matsui 2005). In contrast, defined-benefit pension benefits automatically include a survivor annuity unless the spouse signs a waiver, and Social Security automatically provides benefits for spouses who were married at least 10 years. Does the system allow flexibility in retirement age? American workers enjoy better protection against age discrimination than their counterparts in other developed nations, though it is still rampant. Moreover, many workers with arduous jobs, and those who did not go to college and started work as older teenagers do what only the rich could once do—retire while still healthy enough to enjoy retirement. Early retirement provisions in defined-benefit plans,6 disability insurance, and Social Security’s early retirement option have until now allowed “retirement time” to be one of the most equally distributed sources of well-being in the U.S. economy.7 Unions and employers also tailor pension design to reconcile the reality that people start work at different ages and have very different lifespans. Some blue-collar workers have worked for 50 years at age 67, while many professionals have worked for under 40. Meanwhile, low-income workers have physically harder jobs and also shorter life-spans on average. It is reasonable and, for now, a reality that people who start work early and die relatively young should be able to retire at a younger age and enjoy retirement time. Though retirement age flexibility is one of the strengths of our current system, some experts are calling for changes that would force workers to postpone their retirement. Does the system reward work effort? Workers who begin working at a younger age should be able to retire at a younger age with credit for all years worked. On the other hand, younger retirees also have longer expected retirements, so annual benefits may need to be reduced in order to equalize lifetime benefits. Social Security and employer-provided defined-benefit pensions base benefits on a combination of years worked and retirement age. For example, a typical defined-benefit plan may provide a pension equal to the number of years worked multiplied by 1.5% of an employee’s final average salary, with the benefit reduced by 5% per year for those retiring before the designated “normal” retirement age. Such a kinked benefit structure encourages workers to retire at or before the normal retirement age—first, because the early retirement adjustment factor is typically less than the amount required to equalize lifetime benefits, and second, because workers who retire after the normal retirement age are not compensated for their shorter expected retirements. Though Social Security benefits are gradually adjusted according to age of retirement so as to equalize lifetime benefits for workers who retire up to age 70, the Social Security benefit structure can also encourage earlier retirement because workers stop accruing additional credits after 35 years of work. In theory, defined-contribution plans neither encourage nor discourage early retirement, allowing workers to base retirement decisions purely on income and leisure considerations. In practice, 401(k) accumulations are much lower than what most workers will need to avoid a sharp drop in income after retirement, calling into question whether 401(k)s will really enable workers to choose their retirement age in any meaningful sense. Does the system insure workers against risk? The shift from defined-benefit to defined-contribution plans has forced workers to shoulder more risk. Workers already bear the risk of being too old to work, being laid off, or being disabled. Inflation, longevity, financial, and employment risks once pooled by larger entities are now borne by the individual. These risks include payout risk—the risk that an individual will not manage a lump sum at retirement to protect against inflation and the risk of outliving one’s savings. Running out of income is a main reason older retirees are poorer than younger retirees, and annuitization (price-indexed in the case of Social Security) is one of the major advantages of defined-benefit pensions and Social Security. Pooling allows employers or the government to insure workers against most financial and longevity risks while taking advantage of economies of scale. Though it is theoretically possible for individuals to insure against longevity and financial risks by purchasing annuities, these—like health insurance policies—are costly to purchase in the individual market. Thus, the shift from traditional pensions to individual accounts has saddled workers with risk that would be easy to insure against in a group plan. Is the system efficient? The Social Security Administration has a proven track record of efficient management. Likewise, defined-benefit pension funds are pooled and professionally managed, taking advantage of economies of scale and avoiding the high fees and low returns associated with 401(k) plans and other individual accounts. The Center for Retirement Research estimates that investment returns were 0.8 percentage points higher for defined-benefit plans than for defined-contribution plans between 1985-2001, despite a lower concentration of funds invested in equities. Due to compounding, this small-sounding difference would translate into a 25% larger nest egg over 30 years.8 Participants in 401(k) plans tend to have an all-or-nothing attitude toward risk—either investing heavily in equities (including their employer’s stock) or in very conservative money market funds. Though the latter strategy may make sense from an individual point of view (people are understandably loath to tie their retirement to stock market cycles) it is inefficient from a societal point of view, since savings pooled in a pension fund and professionally invested in a diversified portfolio can earn higher returns while spreading risk, including the risk of retiring during a market downturn. Returns to 401(k)s are also eroded by hidden fees, the subject of recent congressional hearings. Though the lack of transparency makes it hard to quantify the impact of these fees, a survey of 80 providers found that annual fees ranged from $205 to $818 per participant (Los Angeles Times 2006)—or about 0.5% to 2.5% of assets for a medium-sized plan with 500 participants and $20 million in assets. As noted earlier, even a less-than-one-percentage-point difference can have a substantial impact on accumulations, but employers have little incentive to look for low-cost providers since these fees are typically passed on to participants.9 Are resources targeted at retirement? Funds in defined-benefit pensions and the Social Security system are dedicated toward disability and retirement benefits. In contrast, 401(k) plans are “leaky” as workers access funds to pay for health care, home buying, education, or job changes. Allowing participants to access funds before retirement is a popular feature of defined-contribution plans, but does not promote retirement income security. Are benefits portable? Social Security is a model of portability—the vast majority of workers are covered, benefits follow workers from job to job, and it makes no difference if a worker stays at one job for her entire career or changes jobs frequently. In contrast, defined-benefit plans are sometimes criticized because their benefit structure and vesting periods, designed to encourage employee retention, can penalize mobile workers. However, mobile workers are still often better off in retirement with traditional pensions than with 401(k)s, especially since nearly half of 401(k) accounts are cashed out when workers change jobs. Are employer contributions steady and predictable? The main advantage of defined-contribution plans over defined-benefit plans is that employer costs are predictable and obligations are discharged immediately, so it usually makes no difference if a company goes out of business, unless funds are invested in company stock. Though defined-benefit pensions are funded in advance, shortfalls can emerge due to financial market fluctuations, changes in the composition or longevity of the workforce, changes in benefit formulas, and the like. These shortfalls are gradually paid down, but workers can lose some of their pension benefits if their employer goes bankrupt with unfunded pension liabilities, because federal pension insurance is capped.10 Shortfalls also cause employer contributions to spike, especially since the Pension Protection Act of 2006 shortened the amount of time companies in most industries have to close funding gaps. Bankruptcies also have a public cost. High-profile bankruptcies in steel, airlines, auto parts, and other mature industries with significant unfunded pension liabilities created a $23 billion deficit at the Pension Benefit Guaranty Corporation (PBGC), the federal agency that insures corporate pension funds. While the Pension Protection Act was intended to reduce the PBGC’s exposure, it also increased the volatility of employer contributions and may spur more employers to freeze their pensions. Multi-employer pension funds and federal pension insurance are partial solutions to the problem that retirees may outlive their former employers. The fact remains, however, that 401(k) plans are currently the most realistic option for small businesses that want to provide a retirement plan but do not operate on a long-term time horizon and are unable take full advantage of risk pooling and scale economies. Does the system have a positive impact on the economy? Social Security and traditional pensions have a stabilizing effect on the economy because they allow workers to retire when jobs are scarce and shore up consumer demand during recessions. In contrast, 401(k)s have a destabilizing effect on the economy. Bear markets often coincide with recessions, so workers whose 401(k) balances have shrunk may postpone retirement when the economy provides fewer jobs, exacerbating unemployment. How the GRA plan corrects the failures of the current systemGuaranteed Retirement Accounts incorporate the best features of defined-benefit and defined-contribution plans. Like traditional defined-benefit pension plans, GRAs are efficiently managed and benefits are guaranteed for life. Investments are diversified and professionally managed, and accumulations can be accessed only to fund retirement or disability. Like 401(k)s and other defined-contribution plans, Guaranteed Retirement Accounts are fully portable and employer obligations are discharged immediately. They are easy to understand and their value is transparent. They are also immune from company default due to bankruptcy, malfeasance, or corruption. However, GRAs correct three of the worst features of defined-contribution plans: variable and unknown rates of return, leakages into high fees and pre-retirement spending, and lump-sum benefits that do not provide a guaranteed income for life. The GRA plan splits the difference between defined-benefit and defined-contribution plans when it comes to bequests, ensuring that at least half of a participant’s final account balance is paid to the participant or his or her heirs in the form of benefits or bequests. Guaranteed Retirement Accounts effectively increase retirement savings. The challenge with all policies designed to promote savings is that low-income households and even many middle-income households have little money to spare, whereas high-income households can shift existing savings to take advantage of financial incentives without increasing overall savings. This would be true even if the savings incentives for rich and poor families were equal, but is exacerbated by the fact that tax deferrals provide a much larger “carrot” to wealthy families than to middle-class families—and none whatsoever for families too poor to owe taxes. By converting tax deferrals into refundable tax credits, GRAs will instantly boost the retirement savings of low-income households who currently save little or nothing for retirement outside of Social Security. A $600 tax credit covers the entire 2.5% contribution for workers earning $24,000 or less, and greatly reduces the effective contribution rate for other lower-paid workers. Meanwhile, mandatory payroll deductions, partly offset through the tax credits, will effectively increase retirement savings for most middle-class families. The tax credits and mandatory contributions on earnings up to the Social Security cap are unlikely to have much impact one way or another on the savings of high-income households, who will, however, lose significant tax breaks. Together, Guaranteed Retirement Accounts and Social Security will replace approximately 70% of pre-retirement income for the average 40-year worker, which is generally considered the minimum necessary to avoid a significant drop in living standards upon retirement. Though the plan guarantees a 3% rate of return, actual investment returns may be higher. If so, even workers with shorter work histories will achieve a 70% or higher replacement ratio. Guaranteed Retirement Accounts are fair. Employers, workers, and the government share responsibility, because contributions are split between employers and employees and subsidized through a tax credit. This is similar to how Social Security and Medicare are funded, and lies somewhere between traditional defined-benefit pensions in the private sector (where the employer, with taxpayer support, bears the cost) and 401(k) plans (where workers typically make more than half the contributions). For those who believe workers eventually pay for benefits in the form of lower wages, the issue of who makes the contributions may be immaterial. However, splitting the cost between employers, employees, and the government may dampen business opposition to the plan as well as reduce the potential for job loss when the program is introduced. It also agrees with popular opinion.11 The plan will not increase the federal deficit or require a tax increase. Rather, a retirement subsidy in the form of a uniform refundable tax credit will replace subsidies structured as tax deferrals. But unlike tax breaks for 401(k) plans that benefit relatively few people, the refundable tax credits are fairly distributed because everyone contributes to a GRA unless they are in an equivalent or better pension, and the tax credit is the same for everyone. Thus, converting these tax breaks to flat tax credits in order to offset the cost of Guaranteed Retirement Accounts will leave most workers not only better prepared for retirement, but also better off. It will raise the after-tax incomes of households with incomes under $75,000—three-fourths of taxpayers—by amounts ranging from 0.5% to 5.6% of income (Table 2).

Guaranteed Retirement Accounts will also help close the retirement gap between men and women. Because contributions are combined and divided equally between spouses’ individual accounts, GRA benefits are proportional to lifetime household earnings even for people who have been divorced or widowed. While the GRA plan does not subsidize spousal benefits like Social Security, it also does not require that a marriage last for 10 years before spousal credits are earned. The plan also makes unpaid caregivers (whether married or not) of children under six eligible for the $600 Guaranteed Retirement Account credit. Lifetime benefits are tied to work effort rather than retirement age. A key feature is that workers accumulate assets for their retirement every hour they work for pay, thus the system rewards effort and neither subsidizes nor penalizes early retirement. A worker who starts working at 18 and retires at 62 receives the same lifetime benefits as one who starts working at 24 and retires at 68, though annual benefits will be reduced for those who retire earlier. Guaranteed Retirement Accounts insure against risk. Many of the risks borne by workers in individual retirement plans are what are known as “idiosyncratic” risks—the risk that an individual will earn a lower-than-average financial return or live a longer-than-average life span. The government can eliminate these risks simply by pooling accounts. Similarly, it can use a balancing fund to equalize the returns of workers who live through bull and bear markets Guaranteed Retirement Accounts are credited with a predictable, inflation-adjusted rate of return guaranteed by the federal government. This means workers can be assured of a modest but positive return on their retirement savings. In contrast, 401(k) participants with funds invested in the stock market face a significant chance of earning negative real returns on their investments for periods as long as a decade or more, as happened during the 14-year bear market that spanned the 1970s. Besides providing a secure return on investment, GRAs are automatically converted to inflation-adjusted annuities upon retirement to ensure that workers do not outlive their savings or see them eroded through inflation. Monthly retirement benefits are adjusted to reflect changing life-spans, and the government can syndicate longevity risk by purchasing annuities at group rates from insurance providers. Guaranteed Retirement Accounts are efficient and funds are targeted toward retirement. Contributions are made efficiently and consistently through payroll deductions and funds are not accessed until retirement, disability, or death. The Social Security Administration has a proven track record of efficient management and already maintains portable accounts for all workers. Funds are pooled and professionally managed, taking advantage of economies of scale and dispensing with the high fees associated with 401(k) plans and other individual accounts. A system of national accounts with pooled investments is much cheaper to manage than individual 401(k) plans, which can make a big difference to final account balances. In 2004, for example, the Congressional Budget Office estimated that administrative fees for IRAs, 401(k) plans, and similar accounts reduced assets at retirement by 23%, compared to just 5% for the federal Thrift Savings Plan (TSP) and 2% for Social Security (CBO 2004). Like the Thrift Savings Plan and Social Security, Guaranteed Retirement Accounts would have very low administrative costs. The Thrift Savings Plan keeps costs down relative to other defined-contribution plans by, among other things, limiting investment options and services, minimizing marketing costs, and negotiating terms with the firm hired to manage the fund. All of these cost savings would also accrue to GRAs, which have the additional advantage of eliminating trading costs stemming from participants’ changing asset allocations. Guaranteed Retirement Accounts would also minimize administrative costs by piggy-backing on Social Security reporting and recordkeeping. However, some additional information is required, and the individual account structure is less tolerant of recordkeeping errors.12 Generally, costs will be higher during the start-up phase and then gradually drop, because average account size—and therefore participant income—is a major cost factor. Though GRA participants will have lower incomes, on average, than workers participating in the Thrift Savings Plan or other voluntary defined-contribution plans, the automatic 5% annual contribution and the fact that funds cannot be accessed before retirement means the average account size will eventually be comparable or larger. The system is funded through steady employer and employee contributions. The most common practice among employers offering 401(k) plans is a 50-cent match for every dollar contributed by a participating employee, up to 6% of earnings. In other words, the typical 401(k) sponsor contributes only 0-3% of salary, leading to meager and sporadic contributions to worker retirement accounts. The opposite problem exists with defined-benefit plans. In the private sector,13 employers are required to pay the full projected cost of their workers’ retirement in advance, but these costs are variable and unpredictable as funding shortfalls and surpluses emerge due to market fluctuations and other factors.14 With Guaranteed Retirement Accounts, savings accrue steadily and costs are predictable. Advance funding means there are no significant transition costs, though workers who begin participating late in their careers will receive reduced benefits commensurate with their lower contributions. Another advantage of advance funding is that it minimizes the problem of generational booms and busts, since savings automatically grow or contract as more or fewer workers approach retirement. In contrast, a pay-as-you-go system must grapple with the problem of baby boomer retirement, when fewer workers will be supporting a larger number of retirees. The plan will not increase the federal deficit or require a tax increase. Rather, a retirement subsidy in the form of a uniform refundable tax credit will replace subsidies structured as tax deferrals. The total amount will remain unchanged but will be more equitably distributed. Guaranteed Retirement Accounts contribute to the growth and stability of our economy. Guaranteed Retirement Accounts, like Social Security and defined-benefit pensions are automatic stabilizers—they provide household income and boost aggregate demand when people withdraw from the labor market during a slump. Questions about Guaranteed Retirement AccountsWill Guaranteed Retirement Accounts provide enough retirement income for all workers? No. The system is designed to provide a basic retirement income for workers with steady, full-time jobs. However, even low-wage and part-time workers, those who take time to care for young children, and those who experience unemployment spells will accumulate a minimum account balance at 65 of over $50,000 because at least $600 will have been deposited in their accounts each year. Workers who have the means and simply want to enjoy a more comfortable retirement can make supplemental contributions or increase other forms of saving. Is annuitization unfair to retirees who die younger? Annuitization serves an important insurance function, preventing retirees from outliving their retirement benefits. However, benefits are tied to longevity, which is in turn tied to income. This may seem unfair to low-income workers and other groups with shorter lifespans. But when contributions, benefits, and taxes are considered together, the system (like Social Security) is very progressive, since most low-income workers, even if they die younger, will receive more in benefits than they contributed directly and indirectly through taxes. Will the plan appeal to workers? A system of individual accounts with a guaranteed but modest rate of return might not have had much political appeal in the pre-Enron heyday of the 1990s bull market. But as the hype around 401(k)s has faded in the wake of corporate scandals and poor performance, most Americans should welcome a well-designed, efficient, fair, and transparent plan to provide a guaranteed retirement income to supplement Social Security, especially if mandatory contributions for lower income workers are heavily subsidized. Studies show that workers want pensions, are willing to pay for them, and appreciate a modest, steady, and secure annuity. Retirees report higher levels of well-being if their income is guaranteed and, if offered the choice, would prefer a defined-benefit pension over a defined-contribution plan with equal or slightly higher value (Panis 2003; Bender and Jivan 2005). Further, an HSBC bank survey found that, of all the ways to reform pension systems, U.S. workers preferred their government imposing a “compulsory saving” plan rather than reducing benefits, raising taxes, or working longer (HSBC 2007). Is the plan politically feasible? From Table 2, we see that taxpayers making over $75,000 would, on average, see a reduction in their after-tax income under the Guaranteed Retirement Account plan. Could a proposal that costs wealthy people a valuable tax break have legs? Perhaps. The key is knowing that even among higher-income households—those in the top 40%—nearly half (48%) received no tax benefit from contributing to defined-contribution plans or IRAs in 2004—and some who did would still have been better off under the Guaranteed Retirement Account system. Meanwhile, only 13% of households in the bottom 60% received a tax benefit.15 In other words, the majority of Americans, across the income spectrum, would benefit from a fairer and more effective retirement savings plan. However, the plan will also face resistance from some employers (especially those who currently contribute little or nothing toward their workers’ retirement) and from the financial services industry, which makes more money managing 401(k) plans than defined-benefit plans. Why not simply expand Social Security? If subsidies for 401(k)-style plans and IRAs can be reallocated to Guaranteed Retirement Accounts, why not use this money to shore up and expand Social Security? This is certainly an option. Social Security is the cornerstone of our retirement system, and will continue to be the most important source of retirement income for the majority of retired Americans. Moreover, estimates by the Social Security trustees and the Congressional Budget Office predict that the Social Security trust fund will be solvent until 2040 (trustees) or 2052 (CBO), even if Congress does nothing. These estimates are based on pessimistic assumptions, including economic growth projections below current and historical levels. Nevertheless, for political and practical reasons, we cannot ignore the possibility that a relatively modest shortfall will eventually emerge that will need to be dealt with. Meanwhile, the forecast for Medicare is genuinely bleak in the absence of major health care reform. In contrast, the appeal of GRAs is that they are fully pre-funded and annuities are adjusted to take into account changing life-spans. This means the system will never need to be bailed out because of demographic factors, though the government does incur some financial risk. Admittedly, the benefit structure is not as progressive as that of Social Security, which provides more generous disability benefits as well as a higher replacement ratio for low-income workers (the progressivity of the Guaranteed Retirement Account plan comes, rather, from the funding side). However, they are a realistic, affordable supplement to Social Security that will provide an adequate and secure retirement for most workers. Which retirement plans qualify? Recognizing the valuable productivity-enhancing features of defined-benefit pensions, these will be allowed to substitute for a contribution into a worker’s GRA. A qualified defined-benefit pension is one in which the plan sponsor contributes 5% of payroll per year, so sponsors who make sporadic and uneven contributions will not qualify. Hybrid plans like cash-balance plans (which technically are classified as defined-benefit plans) are also exempt as long as contributions are at least 5% per year and retirement income is guaranteed for life (not paid out in a lump sum). The arguments in favor of allowing well-funded defined-benefit pensions to opt out are compelling. First, for the majority of participants, defined benefits work well, especially in public and private sector multi-employer arrangements. Employers can tailor the rules on vesting, benefit dispersal, etc., to meet the needs of particular workforces. Multi-employer plans—like those in the public sector or in trucking, mining, services, and building trades—are especially flexible in allowing workers to accumulate pension credits across jobs, giving workers an added incentive to invest in non-employer-specific job training. Furthermore, there is evidence that defined-benefit pensions help employers enhance workers’ productivity by lowering turnover rates and encouraging training and loyalty, which benefits both firms and workers. Employee retention is expected to pose a growing challenge as the workforce ages. Last but not least, pension funds help other investors and the economy by monitoring corporate management and promoting corporate reforms, especially in the wake of the Enron meltdown. Many workers are concerned that their single employer defined-benefit pensions may fail. But the requirement for continuous 5% contributions is even more stringent than the funding rules in the recent Pension Protection Act. Despite the strict funding requirement, employers will be encouraged to keep their defined-benefit pension or start new ones because defined-benefit pensions will have tax advantages over Guaranteed Retirement Accounts, since contributions to fund an annual benefit up to $180,000 will remain tax exempt, while employers will no longer have the option of offering a tax-favored 401(k) plan. Why not preserve tax breaks for 401(k)s and IRAs? It would be extremely expensive to subsidize both 401(k)s and Guaranteed Retirement Accounts, and the latter are a much more effective and equitable way to increase retirement savings. Some proposed 401(k) reforms, such as automatic enrollment, a cap on fees, mandatory annuitization, and converting tax exemptions to tax credits, would greatly improve 401(k)s but would still leave the individual worker exposed to substantial financial risk. Moreover, none of these proposals would ensure an adequate level of contributions, or any contribution at all. These plans will not be abolished, but under the Guaranteed Retirement Account plan additional contributions will no longer be tax exempt. We expect that many 401(k) plans will survive because high-income employees appreciate the automatic savings feature and the possibility of an employer match. Accumulations in 401(k) plans and other retirement plans that exist before the bill goes into effect will be treated under the old tax rules. One alternative to eliminating 401(k) and IRA tax breaks altogether is to cap pre-tax contributions at $5,000—the current IRA limit. Assuming that the median contribution to a 401(k) is about 9% of pay, a $5,000 contribution limit would have no effect on most employees who make $55,000 or less, or more than 80% of working Americans. However, the Tax Policy Center has estimated that capping contributions at $5,000 would reduce the funds available for Guaranteed Retirement Account tax credits by more than half. Who manages the investment? The accounts will be managed by a unit of the Thrift Savings Plan with its own trustees, who in turn will hire commercial money managers. The trustees will be independently appointed, half by the president (subject to Senate confirmation) and half by Congress. They will have terms structured in a similar fashion to the Federal Reserve Board of Governors. Does the plan increase compliance and administrative costs? The plan is designed to be simple and to work within existing structures in order to minimize compliance and administrative costs. However, some additional reporting will be required. State and local governments will need to notify the Social Security Administration of marriages and divorces so that contributions can be apportioned between spouses’ individual accounts. Likewise, states will need to report unemployment insurance benefits. Public sector workers in some states and others not currently eligible for Social Security will need to enroll in the plan. Finally, caregivers who do not currently have to file tax returns will need to do so in order to be eligible for the tax credit. Where does the $600 figure come from? Using its micro-simulation model, the Urban-Brookings Tax Policy Center has calculated that adding all defined-contribution plan and IRA contributions to taxable income would be more than sufficient to fund a $600 tax credit for all taxpayers with earned income in 2008 (“married filing jointly” taxpayers receive $1,200). Thus, $600 is a rough estimate of what would be a revenue-neutral tax credit in 2008.16 However, the cost of tax breaks for defined-contribution plans and IRAs is projected to grow, both because the 401(k) contribution limit is scheduled to keep rising and because tax rates will rise if recent tax cuts are allowed to expire. Thus, the Tax Policy Center estimates that, over the next decade, these tax subsidies could be converted to Guaranteed Retirement Account tax credits worth $800 per taxpayer with no negative impact on federal revenues. However, if the Bush tax cuts are made permanent and Alternative Minimum Tax relief is extended, a $600 tax credit would be closer to revenue neutral over this period. Why can’t workers bequeath the full amount of their account balances? A popular feature of most defined-contribution plans is that participants who die bequeath their remaining account balances to heirs if they have not already depleted their retirement savings. In contrast, defined-benefit pension and Social Security benefits stop after beneficiaries die, even if they have not lived long enough to receive any payments. The Guaranteed Retirement Account solution is a compromise. Workers can bequeath half their account balances—that is, the worker’s own contributions, plus interest, but not the employer contributions—minus any benefits received. This is similar to the “cash refund” feature of annuities purchased through the federal Thrift Savings Plan, an optional feature that normally reduces the value of an annuity. However, in this case the cash refund feature is paid for by redistributing half of the account balances of workers who die before retiring, rather than by reducing the annuity.17 How much risk is the government incurring? Based on current bond yields and a conservative estimate of future stock returns, a portfolio divided equally between long-term Treasuries, investment-grade corporate bonds, and stocks should earn a real rate of return of around 3.5%, enough to provide a cushion above the guaranteed rate.18 In the event of a protracted slump, the government retains the option of lowering the guaranteed return and allowing participants to access their funds. In other words, the federal government only guarantees that participants will not be locked into a lower rate, not that participants will earn a 3% real return in perpetuity. As for longevity risk, monthly retirement benefits are adjusted to reflect changing lifespans, and the government can syndicate longevity risk by purchasing annuities at group rates from insurance providers. Are there any successful models for the Guaranteed Retirement Account plan? Guaranteed Retirement Accounts are similar to retirement accounts for university employees, cash balance-type plans (including some public employee plans in Indiana and Texas), and what are known as “non-financial defined-contribution accounts” in four European countries (Italy, Latvia, Poland, and Sweden). The Teachers Insurance Annuity and College Retirement Equities Fund (TIAA-CREF), the pension fund for university professors, is the largest pension fund in the United States. The TIAA portion guarantees a 3% nominal return, and the trustees have added a supplement every year since 1948.19 How do Guaranteed Accounts compare with other reform ideas?Despite their well-documented problems, Congress expanded the tax breaks for defined-contribution plans in the Pension Protection Act of 2006, allowing individuals to shelter up to $20,500 from tax in a retirement account in 2007.20 While expanding tax breaks for defined-contribution plans, Congress imposed additional burdens on defined-benefit pensions, with new funding rules that make employer contributions more unpredictable. Meanwhile, participants have never been allowed to contribute a single dollar to defined-benefit pensions, let alone an extra $20,000. There is widespread concern among retirement experts about many of the problems identified in this paper, including the low savings and employer pension coverage rates for moderate- and low-income workers, falling Social Security replacement rates, and lopsided tax incentives favoring highly compensated employees. Likewise, the idea of a supplement to Social Security has been around for a long time, including a Clinton administration initiative calling for the government to deposit funds into Universal Savings Accounts (USAs) for low- and moderate-income workers. The Guaranteed Retirement Accounts plan is similar in some ways to proposals for mandatory workplace retirement plans designed to fill gaps in the so-called “second tier” above basic government plans like Social Security. Daniel Halperin, economists Christian Weller, Dean Baker, and Alicia Munnell, and the pension economists at the World Bank have all made similar proposals. The GRA plan goes one step beyond many of these proposals because it seeks to eliminate the ineffective and regressive tax expenditures for 401(k)-style plans and use these funds to increase the retirement income of all workers. The plan covers all workers, not just those in low- and moderate-income families, and includes mandatory employer and employee contributions, not just a government subsidy. While far reaching, the plan is also affordable, since it does not worsen the federal deficit or require a tax increase. The Guaranteed Retirement Account plan is also more equitable and effective than proposals to raise the retirement age or to close gaps in 401(k)s through automatic enrollment and other measures. Raising the retirement age Advocates for postponing retirement are spread across the political spectrum—from Barbara Butrica, Kevin Smith, and Eugene Steuerle of the Urban Institute (Butrica et al. 2006) to David John of the Heritage Foundation (John 2005). Meanwhile, most workers still retire before the current Social Security “normal” retirement age.21 Among the most influential and liberal proponents of this view are pension policy consultant John Turner and Alicia Munnell of Boston College’s Center for Retirement Research. Munnell believes that the government establishes retirement age norms through Social Security’s Earliest Eligibility Age and Normal Retirement Age, and that these may also encourage age discrimination because firms fear older workers will retire and are therefore less likely to hire and train them.22 Both Munnell and Turner believe people tend to be shortsighted in planning for retirement and therefore might benefit if the government encouraged them to retire later by, say, raising the Earliest Eligibility Age (Munnell et al. 2004; Munnell 2006; Turner 2007). However, it is obvious that retirement-aged workers value leisure time considerably, since they choose to forgo huge monetary gains from working longer. An Urban Institute study, for example, estimates that many workers would increase their consumption in retirement by 25% if they delayed retirement from 62 to 67 (Butrica et al. 2004). There is no convincing evidence most older people can work longer just because they live longer. We do not know if longevity is increasing because we are extending the lives of frail adults or because we are healthier at older ages, and we do not know how well matched older people are to today’s jobs. Since 1981, the share of older workers reporting limitations in their ability to work has stayed steady at about 15-18%. While the share of jobs demanding physical effort is declining, especially for men, the share requiring good eyesight or computer skills is increasing (Johnson 2004). Working longer is often not a choice for workers who develop health problems or are laid off late in their careers. According to a recent McKinsey & Company survey, 40% of workers are forced to retire earlier than they had planned, with health, or the health of a family member, the reason cited for over half of these early retirements. Many others are forced to retire because of age discrimination, layoffs, and plant shutdowns (Rotenberg 2006). Many older workers do not stay in their career jobs. Instead of 60 being “the new 50,” it has become the new 17, as older people re-enter the job market as retail clerks or in other low-paid occupations. Elderly workers over age 65 have jobs with less status than workers aged 55-64.23 Advocates of raising the retirement age, including Alicia Munnell, are aware of the physical limitations older blue-collar workers have, the changing nature of jobs, and the existence of chronic age discrimination. Like us, they want workers to get the jobs they want at all ages. However, it is less likely that older workers will obtain jobs on their own terms if their retirement income is more insecure. Guaranteed Retirement Accounts encourage healthy and happy workers to postpone their retirement if they want to, because participants earn retirement benefits for every hour they work. However, they also make it easier for the majority of workers who need or want to retire before age 67 to do so by augmenting retirement incomes without designating a “full benefit” age, and by allowing workers to make supplemental contributions during their working lives. Auto 401(k) enrollment William Gale, Jonathan Gruber, and Peter Orszag of the Hamilton Project (Gale et al. 2006) have proposed that employers automatically enroll employees in individual accounts, choose appropriate investments, roll funds over when workers leave, and convert lump sums to annuities upon retirement—though workers can opt out of any of these default choices. The authors also call for converting tax deductions into refundable tax credits. This is the most important but least discussed part of the proposal, probably because it benefits neither the financial industry nor well-off households. The Hamilton Project plan, if adopted in its entirety, would increase retirement savings and make the system more equitable. But it retains many of the flaws of our current system: workers continue to bear the financial risk of defined-contribution plans and pay high fees to private money managers; participation is not mandatory; employers are not required to extend coverage or make contributions; and workers can continue to access funds for reasons other than retirement. Tax credits targeting lower-income workers Many experts, including Alicia Munnell and Daniel Halperin, have given up on employers ever providing meaningful pensions for lower paid workers. Munnell and Halperin have called for the government to directly subsidize the retirement of these workers and their spouses by depositing $300 tax credits into USA-style accounts (Munnell and Halperin 2005). The tax credits would be phased out for middle- and high-income workers, who could instead take advantage of government matching grants (also phased out with income) or existing tax deductions for 401(k)-style accounts. Munnell and Halperin do not require employers to offer workplace retirement plans, though they propose a patchwork of changes to the existing system intended to expand coverage and make retirement income more secure. This includes allowing pension plans to exclude low-income workers who are eligible for the tax credits, in the hopes that this would make it easier for employers to provide retirement benefits. Thus, the onus would be on the government to fund the retirement of lower paid workers. The authors propose paying for the tax credits by taxing pension fund earnings. Existing tax expenditures for commercial accounts remain untouched, despite the problems with 401(k) plans—high fees, early withdrawals, spotty contributions, and top-heavy benefits—that the authors, among others, have documented. ConclusionAmerica’s pensions are broken—tax breaks for retirement plans are at an all-time high, while pension coverage has not budged in 30 years. Most Americans have less retirement income security than they did a generation ago. However, taxpayers’ subsidies for the 401(k) plans of the wealthiest Americans just keep growing. Tax breaks for 401(k) plans amounted to $110 billion in 2006, most of which went to households in the top tax brackets. Not only do these tax breaks go to those who need them the least, they do not cause the savings rates to increase. The GRA plan calls for all workers not enrolled in an equivalent defined-benefit pension to enroll in a Guaranteed Retirement Account. Employers and employees pay a total of 5% of pay, which will earn a guaranteed and inflation-protected rate of return. These funds will be converted to life annuities upon retirement. Most people’s contributions will be paid by the federal government with a $600 tax credit. This plan pays for itself—it will not increase the federal deficit or require a tax increase—by eliminating all tax deductions for contributions to 401(k) plans. Defined-benefit plans keep their tax-favored status. The GRAs are administered by the Social Security system eliminating all individual account management fees. Retirement security cannot be paid for by workers, employers, or the government alone—guaranteeing a basic income floor requires sharing responsibility. Additionally, workers simply have to save more to be able to retire. Mandating contributions through a guaranteed retirement account means the low-income and middle-class workers are subsidized; the federal government takes on longevity and financial risk; accumulations are sufficient because there are no account leakages through skipped contributions and costly fees; and the tax subsidies for retirement accounts actually raise the national savings rates and secure Americans’ retirement futures. —Teresa Ghilarducci, after 25 years as a professor of economics at the University of Notre Dame, will be the Schwartz Chair in Economic Policy Analysis at the New School for Social Research in January 2008. She is the 2007 and 2008 Wurf Fellowship holder at the Labor and Worklife Project at the Harvard Law School. —We gratefully acknowledge the generous support of the Rockefeller Foundation. Endnotes1. Employment-based retirement plans are usually classified as defined-benefit plans, defined-contribution plans, or hybrids (such as cash balance plans). Defined-benefit pensions provide retirees with a guaranteed income for as long as they live. Retirement benefits are determined in advance, usually based on an employee’s years of service and their final average earnings in the years before retirement. Private sector defined-benefit pensions are guaranteed, up to a limit, by a federal pension insurance program. Defined-contribution plans like 401(k)s are tax-advantaged savings plans set up by employers. They were originally designed as add-ons to traditional defined-benefit pensions, though now they are often the only retirement plan offered by employers. These accounts are managed by participants themselves, who choose from a number of investment options, typically stock, bond, money market mutual funds, or company stock. Instead of a monthly pension check, participants typically get a lump sum when they retire, the size of which depends on how much they set aside, how well their investments did, and whether they borrowed or cashed out any of the money in their accounts. 2. The Social Security earnings cap is currently $97,500 (in 2007). It changes annually to reflect changes in average wages. 3. Data on pension coverage rates for American workers come from different sources and no one source has consistently measured coverage rates since the 1980s. One frequently cited source is the Employee Benefits Research Institute (see, for example, Employee Benefits Research Institute, EBRI Data Book on Employee Benefits, Washington, D.C., 1995; and Craig Copeland, Employment–Based Retirement Plan Participation: Geographic Differences and Trends, 2005, EBRI Issue Brief, November 2006). For a discussion of the effect of defined contributions on coverage, see Teresa Ghilarducci, The Changing Role of Employer Pensions: Tax Expenditures, Costs and Implications for Middle Class Elderly, presented to the Levy Economics Institute conference on Government Expenditures on the Elderly, April 29-30, 2006; and Geoffrey Sanzenbacher, Estimating Pension Coverage Using Different Data Sets, Boston College Center for Retirement Research, August 2006. 4. Includes people looking for work. (Source: U.S. Census Bureau News, New Census Bureau Data Reveal More Older Workers, Homeowners, Non-English Speakers, September 12, 2007.) 5. Author’s calculation, based on Burman et al. 2004. 6. Defined-benefit plans offer older workers an exit out of the labor force instead of joining the ranks of the unemployed. This makes a significant difference in wide swathes of the Midwest where steel and auto industries have retrenched and 57-year-old displaced men cannot find work. 7. White-collar workers tend to start work at older ages than blue-collar workers and retire later—both groups obtain about the same amount of retirement leisure, even though educated workers, with higher socio-economic status, live longer. (Teresa Ghilarducci and Kevin Neuman, “The Distribution of Early Retirement Leisure: Evidence from the HRS,” submitted to Journal of Aging Studies, February, 2005.) 8. Author’s calculations based on a 7.9% return for defined-benefit plans versus a 7.1% return for defined-contribution plans (Source: Alicia H. Munnell and Annika Sundén, Coming Up Short: The Challenge of 401(k) Plans, Washington, D.C.: Brookings Institution Press, 2004). 9. This was not always the case: in 1988, 87% of U.S. employers paid all 401(k) administrative costs, compared to about 25% today, according to Hewitt Associates (as cited in Hamilton et al. 2006). 10. The Pension Benefit Guarantee Corporation guarantees pension benefits up to $49,500 a year. 11. According to David Madland’s dissertation research at Georgetown University, based on the results of a poll of workers conducted by the Rutgers University Heldrich Center, most think workers should not shoulder most of the cost of funding retirement, and instead see employers, the government, or all three groups bearing the responsibility (David Madland, A Wink and a Handshake: Why the Collapse of the U.S. Pension System has Provoked Little Protest, Dissertation, Georgetown University, 2007). 12. Contributions that are not immediately credited to the right account are not as big a problem for defined-benefit plans as for defined-contribution plans (as long as errors are eventually fixed), since benefits are based on earnings and years of service rather than investment returns. Guaranteed Retirement Accounts would also leave room for error, since the government only guarantees a 3% rate of return while maintaining a balancing fund that would function, in part, like Social Security’s suspense fund. 13. In the public sector, workers may contribute to their pensions. 14. From the worker’s perspective, higher-paid workers may lose any uninsured portion of their pensions if an employer with an underfunded pension plan declares bankruptcy; and pension benefits accrue unevenly over the course of a worker’s career because the benefit structure is back-loaded (penalizing mobile workers, among other things). Nevertheless, defined-benefit pensions are still a much more effective way to accumulate retirement savings than 401(k) plans for most workers. 15. Author’s calculations, based on Burman et al. 2004. 16. The Guaranteed Retirement Account plan extends eligibility for the full tax credit to individuals receiving unemployment benefits and to caregivers of children under age six. The Tax Policy Center’s simulation implicitly does not extend the credit to caregivers or to individuals collecting unemployment insurance if the family had no earned income in 2008. On the other hand, the Tax Policy Center does extend the credit to stay-at-home or retired spouses with no children under six if the other spouse had earned income. 17. Author’s calculations, based on 2002 period life table from the Social Security Administration (http://www.ssa.gov/OACT/STATS/table4c6.html). 18. Dean Baker, J. Bradford DeLong, and Paul Krugman estimate that real S&P 500 returns going forward will be 4.5% (2 percentage points less than the historical average), based on current dividend yields, current net stock buybacks, and long-run dividend growth (see “Asset Returns and Economic Growth,” March 24, 2005). Real interest rates on long-term Treasuries have averaged just under 3% since 1870 (James A. Girola, The Long-Term Real Interest Rate for Social Security,” U.S. Treasury Department Research Paper No. 2005-02, March 30, 2005) and are currently around 2.4% (inflation indexed 20-year Treasuries, September 6, 2007). The return on Moody’s AAA-rated bonds is currently around 9 basis points higher than Treasuries—or 3.3% in real terms (http://www.federalreserve.gov/releases/h15/20070911/). As an additional point of comparison, Canada’s chief actuary estimates that the Canada Pension Plan, which is conservatively invested to avoid a change in the contribution rate, will earn a real rate of return of 4.2% over a 75-year projection period (http://www.cppib.ca/faqs.html). 19. Most years, TIAA’s nominal 3% guaranteed return is significantly lower than GDP growth, which has averaged 7% in the postwar period in nominal terms. Thus, Guaranteed Retirement Accounts have a guaranteed rate of return that is higher than the TIAA guaranteed rate. However, the actual TIAA return has been much higher than its guaranteed rate—6.6 % over the past 10 years (or about 3.9% in real terms—author). (TIAA-CREF Web site, accessed February 2, 2007: 20. The $20,500 limit applies to individuals age 50 and over, and will be adjusted for inflation in subsequent years. For those under 50, the 2007 limit is $15,500. 21. The average retirement age is 63 for men and 62 for women. (Alicia H. Munnell, Anthony Webb, and Luke Delorme, A New National Retirement Index, Center for Retirement Research Issue in Brief #48, June 2006.) 22. John Turner argues that older Americans are healthier at older ages by combining two sources of evidence—the mixed evidence that older people are healthier than they were in the past (people smoke less but they have greater incidences of diabetes), the decline in reported disability claims, and increased life expectancy at 65—as evidence for today’s older workers being healthier than previous generations (Turner 2007). 23. They are less likely to be in occupations classified as “executive,” “professional,” or “technician” and more likely to be in “sales” and “service” occupations. (Sara E. Rix, Aging and Work: A View from the United States, AARP Public Policy Institute Research Report, February 2004). ReferencesBell, Elizabeth, Adam Carasso, and C. Eugene Steuerle. 2004. “Retirement savings incentives and personal savings.” Urban-Brookings Tax Policy Center Tax Notes, December 20. Bender, Keith A., and Natalia A. Jivan. 2005. What Makes Retirees Happy? Boston College Center for Retirement Research Issue Brief #28. Boston, Mass.: Boston College. Bosworth, Barry, and Lisa Bell. 2005. The Decline in Saving: What Can We Learn From Survey Data? Unpublished draft. Washington, D.C.: The Brookings Institution, August 11. Burman, Leonard E., William G. Gale, Matthew Hall, and Peter R. Orszag. 2004. Distributional Effects of Defined Contribution Plans and Individual Retirement Accounts. Washington, D.C.: Urban-Brookings Tax Policy Center. Butrica, Barbara A., Howard M. Iams, and Karen E. Smith. 2003. It’s All Relative: Understanding the Retirement Prospects of Baby-Boomers. Boston College Center for Retirement Research Working Paper #2003-21. Boston, Mass.: Boston College. Butrica, Barbara, Richard W. Johnson, Karen E. Smith, and C. Eugene Steuerle. 2004. Does Work Pay at Older Ages? Urban Institute Research Report. Washington, D.C.: Urban Institute. Butrica, Barbara, Karen E. Smith, and C. Eugene Steuerle. 2006. Working for a Good Retirement. Urban Institute Brief. Washington, D.C.: Urban Institute. Chernozhukov, Victor, and Christian Hansen. 2004. The effects of 401(k) participation on wealth distribution: An instrumental quantile regression analysis. Review of Economics & Statistics. Vol. 86, No. 3. Congressional Budget Office. 2004. Administrative Costs of Private Accounts in Social Security. Washingon, D.C.: CBO. Delorme, Luke, Alicia H. Munnell, and Anthony Webb. 2006. Empirical Regularity Suggests Retirement Risks. Boston College Center for Retirement Research Issue Brief. Boston, Mass.: Boston College. Engen, Eric, and William G. Gale, 2000. The Effects of 401(k) Plans on Household Wealth: Differences Across Earnings Groups. National Bureau of Economic Research Working Paper 8032. NBER. Gale, William G., Jonathan Gruber, and Peter R. Orszag. 2006. Improving Opportunities and Incentives for Saving by Middle- and Low-Income Households. A Hamilton Project Discussion Paper. Washington, D.C.: Brookings Institution. HSBC. 2007. The Future of Retirement: What People Want. John, David C. 2005. Improving Retirement Security: Three Reforms. Heritage Foundation Study. Washington, D.C.: Heritage Foundation. Johnson, Richard. 2004. Trends in job demands among older workers. Monthly Labor Review. July. Los Angeles Times. 2006. Retirement at risk: Fees eat away at employees’ 401(k) nest eggs. HR Investment Consultants, as cited by Walter Hamilton, Kathy M. Kristof, and Josh Friedman. 2006. Matsui, Amy. 2005. Spousal Rights in Individual Accounts: Improving Women’s Retirement Security. Presented at “When Women Gain, So Does the World,” The Institute for Women’s Policy Research’s Eighth International Women’s Policy Research Conference. Munnell, Alicia H. 2003. The Declining Role of Social Security. Boston College Center for Retirement Research #JTF6, Just the Facts on Retirement Issues. Boston, Mass.: Boston College. Munnell, Alicia H., Kevin B. Meme, Natalia A. Jivan, and Kevin E. Cahill. 2004. Should We Raise Social Security’s Earliest Eligibility Age? Boston College Center for Retirement Research Issue Brief. Boston, Mass.: Boston College. Munnell, Alicia H., Francesca Golub-Sass, and Andrew Varani. 2005. How Much Are Workers Saving? Boston College Center for Retirement Research Issue Brief #34. Boston, Mass.: Boston College. Munnell, Alicia H., and Daniel Halperin. 2005. “How Should the Private Pension System be Reformed?” in William G. Gale, John B. Shoven, and Mark Warshawsky, eds., The Evolving Pension System. Washington, D.C.: Brookings Institution Press. Munnell, Alicia H. 2006. Policies to Promote Labor Force Participation of Older People. Boston College Center for Retirement Research Working Paper. Boston, Mass.: Boston College. Organisation for Economic Co-operation and Development. 2007. Pensions at a Glance: Public Policies Across OECD Countries. Washington, D.C.: OECD. p. 33. Panis, Constantijn W.A. 2003. Retiree Satisfaction and Annuities. Rand Working Paper 03-17. Rotenberg, Joanna. 2006. The Retirement Challenge: Expectations vs. Reality. Presentation on McKinsey & Company’s 2006 Consumer Retirement Survey at the EBRI/AARP Pension Conference, Washington, D.C., May 15. Turner, John. 2007. Promoting Work: Implications of Raising Social Security’s Early Retirement Age. Boston College Center for Retirement Research. Boston, Mass.: Boston College. U.S. Office of Management and Budget. 2007. FY 2008 Budget, Analytical Perspectives, Federal Receipts and Collections. Weller, Christian, and Edward N. Wolff. 2005. Retirement Income: The Crucial Role of Social Security. Washington, D.C.: Economic Policy Institute. |

|

|||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||